In the wild world of cryptocurrency, numbers dance like a caffeinated squirrel. The market cap serves as the pulse of this digital ecosystem, revealing which coins are thriving and which are barely hanging on. Understanding this vital metric can feel like deciphering hieroglyphics—unless you’ve got the right guide.

Table of Contents

ToggleOverview Of Cryptocurrency Market Cap Analysis

Cryptocurrency market cap analysis assesses the total value of a cryptocurrency, calculated by multiplying the current price of the asset by its circulating supply. This metric serves as an essential indicator of a cryptocurrency’s size, popularity, and liquidity. Understanding market capitalization helps investors gauge the market’s dynamics and identify potential investment opportunities.

Various tiers exist within the cryptocurrency market cap landscape. Large-cap cryptocurrencies, like Bitcoin and Ethereum, typically display greater stability and are less prone to dramatic price swings. Mid-cap cryptocurrencies may offer a balance between risk and reward, while small-cap cryptocurrencies often exhibit higher volatility but can lead to significant gains for daring investors.

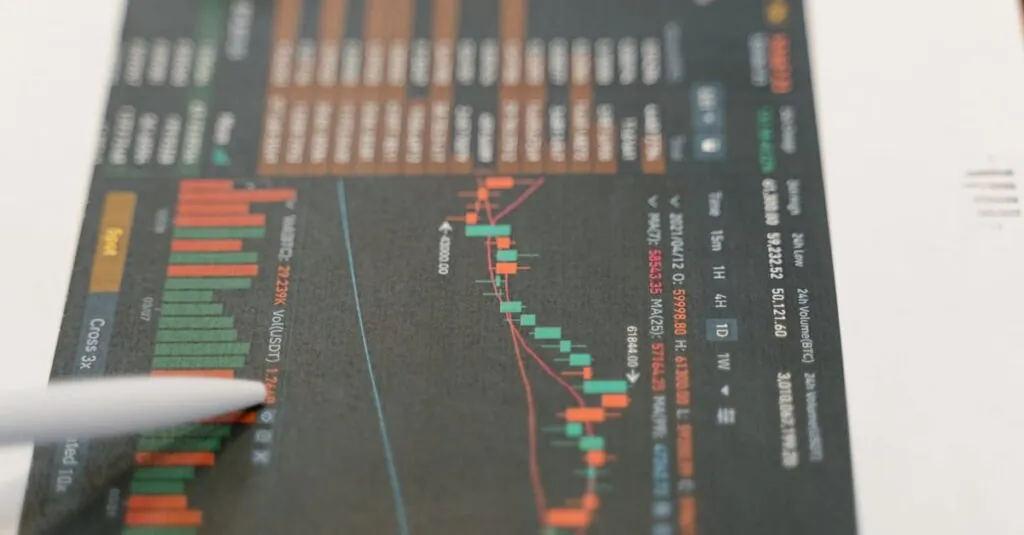

Market cap rankings highlight the top cryptocurrencies by their total value, offering insights into market trends. Data platforms like CoinMarketCap and CoinGecko present real-time information on market capitalization, transaction volumes, and price fluctuations, providing a comprehensive view of the market. Changes in market cap can signal shifts in investor sentiment, regulatory developments, or technological advancements.

Tracking historical market cap data reveals trends over time, assisting investors in making informed decisions. It allows them to analyze past performance against current values, fostering a deeper understanding of market movements. By examining market cap alongside other indicators, such as trading volume and price action, investors can develop a more robust strategy.

Performance comparisons among different cryptocurrencies can illustrate their competitive standing within the overall market. For instance, comparing Bitcoin’s long-term trends with newer entrants helps investors identify shifts in power or emerging opportunities. Analyzing market cap serves as a fundamental tool in navigating the intricate world of cryptocurrencies.

Importance Of Market Cap In Cryptocurrency

Market capitalization serves as a crucial metric for evaluating cryptocurrencies. Understanding this concept provides insight into a cryptocurrency’s overall value and market position.

Understanding Market Capitalization

Market capitalization represents the total value of a cryptocurrency. It derives from multiplying the current price by the circulating supply of coins. This calculation helps categorize cryptocurrencies into tiers based on their risk and stability. Large-cap cryptocurrencies, such as Bitcoin and Ethereum, showcase relative stability and lower risk. Conversely, mid-cap and small-cap cryptocurrencies present higher volatility, but some investors see potential for substantial returns.

Market Cap vs. Other Metrics

Market cap stands out among other financial metrics in the cryptocurrency market. While volume indicates trading activity, market cap reflects overall size and investor confidence. The price alone can be misleading without context, as it doesn’t account for the circulating supply. Additionally, metrics like liquidity and volatility provide further insights, but they cannot replace the foundational importance of market cap. Evaluating these metrics alongside market cap facilitates a deeper understanding of cryptocurrency dynamics.

Factors Influencing Cryptocurrency Market Cap

Several factors significantly influence the market capitalization of cryptocurrencies. Understanding these variables helps investors make informed decisions.

Supply And Demand Dynamics

Supply and demand play crucial roles in determining cryptocurrency prices. A higher demand for a digital asset increases its price, subsequently boosting its market cap. Limited supply, particularly in coins with capped quantities like Bitcoin, can drive prices further upward. When more investors seek a particular cryptocurrency, competition intensifies, enhancing its market position. Conversely, an oversupply can lead to price drops, impacting total market cap negatively. Tracking supply metrics, such as circulating and total supply, offers insights into how these factors affect pricing and market capitalization.

Market Sentiment And Investor Behavior

Market sentiment directly affects cryptocurrency valuations. Positive news or endorsements from influential figures can result in surges in investor interest, pushing prices higher. Negative news can trigger panic selling, which lowers prices and market capitalization. Investor behavior, influenced by trends, social media, and market psychology, contributes to these fluctuations. Moreover, sentiment analysis can detect bullish or bearish trends, allowing traders to anticipate price movements. Understanding these behavioral patterns aids investors in navigating the market and adjusting strategies accordingly.

Analyzing Market Cap Trends

Market cap trends offer valuable insights into the cryptocurrency landscape. Observing patterns helps investors identify potential opportunities or threats.

Historical Market Cap Trends

Historical data reveals how market caps have shifted over time. Significant price movements accompany major events in the crypto industry, affecting both large-cap and small-cap cryptocurrencies. For example, Bitcoin’s rise to nearly $60,000 in April 2021 marked one of the highest market caps recorded. Analyzing past market performance allows investors to discern cyclical patterns, enhancing future strategy formulation. Trends from 2017 to 2021 showcase remarkable volatility, with multi-billion dollar fluctuations occurring regularly. Understanding these historical movements supports informed decision-making in today’s dynamic market.

Market Cap Projections and Forecasts

Market cap projections provide insights into the future potential of cryptocurrencies. Analysts use data-driven models to estimate how various factors will influence market valuations. Positive regulatory changes often uplift market sentiment, leading to increased market caps. Conversely, technological setbacks or security breaches can hinder growth. Recent forecasts predict that the overall cryptocurrency market cap could reach $5 trillion by 2025, reflecting growing institutional interest. Tracking these projections aids investors in positioning themselves strategically within this evolving financial landscape.

Major Players In The Cryptocurrency Market

The cryptocurrency market features several key players that shape its landscape. These influential coins dominate by market capitalization, providing insights into the overall health of the sector.

Top Cryptocurrencies By Market Cap

Bitcoin leads as the largest cryptocurrency, consistently holding over 40% of the market cap. Ethereum follows closely, often recognized for its smart contract features and growing ecosystem. Third, Binance Coin serves significant utility within the Binance exchange and has shown remarkable growth rates. Tether, as a stablecoin, plays a crucial role in maintaining liquidity across various exchanges. Cardano, with its unique proof-of-stake model, continues to gain traction and market trust. Other notable mentions include Solana and Ripple, both of which are advancing through innovative technologies.

Emerging Cryptocurrencies To Watch

Emerging cryptocurrencies demonstrate potential for substantial growth. Avalanche stands out due to its high transaction speeds and low fees, attracting developers to its platform. Fantom, utilizing a directed acyclic graph technology, presents unique scalability options. Polkadot aims to enable cross-chain compatibility, fostering an interconnected blockchain environment. Chainlink continues to gain attention for its decentralized oracle network, enabling smart contracts to access real-world data. Additionally, Algorand’s focus on sustainability and efficiency makes it worth monitoring. These cryptocurrencies show promise, indicating future market shifts and investment opportunities.

Navigating the cryptocurrency market requires a keen understanding of market capitalization and its implications. By analyzing market cap trends and the factors influencing them, investors can make informed decisions that align with their financial goals. Keeping an eye on the performance of different cryptocurrencies helps identify emerging opportunities and potential risks.

As the market continues to evolve, staying updated with real-time data and market sentiment will be crucial. With projections indicating significant growth, the landscape of cryptocurrencies promises exciting prospects for those willing to engage with it thoughtfully. Embracing market cap analysis is essential for anyone looking to thrive in this dynamic environment.